stop quote vs trailing stop quote

Designed to initiate a sale or purchase when a securities price hits a certain point. If the calculated stop price is reached the order will be activated and become a market order.

Options Trailing Stop Loss By Optiontradingpedia Com

Trailing Stop Loss Vs.

. When the stock price touches some level it triggers an order. Lets say that the EURUSD exchange rate from our example rose to 12400. Here hard stops are placed on a set price.

For a retail trader like yourself theres no practical benefit to stop limits. Stop orders all do basically the same thing. When your trailing stop limit order is triggered the execution order for the trade will be.

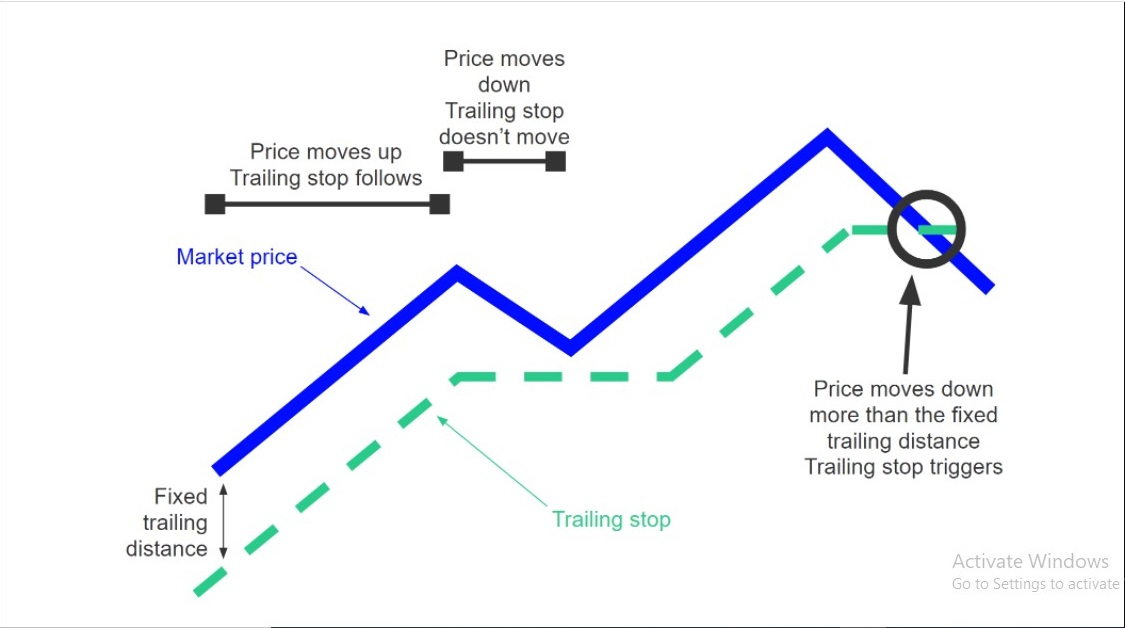

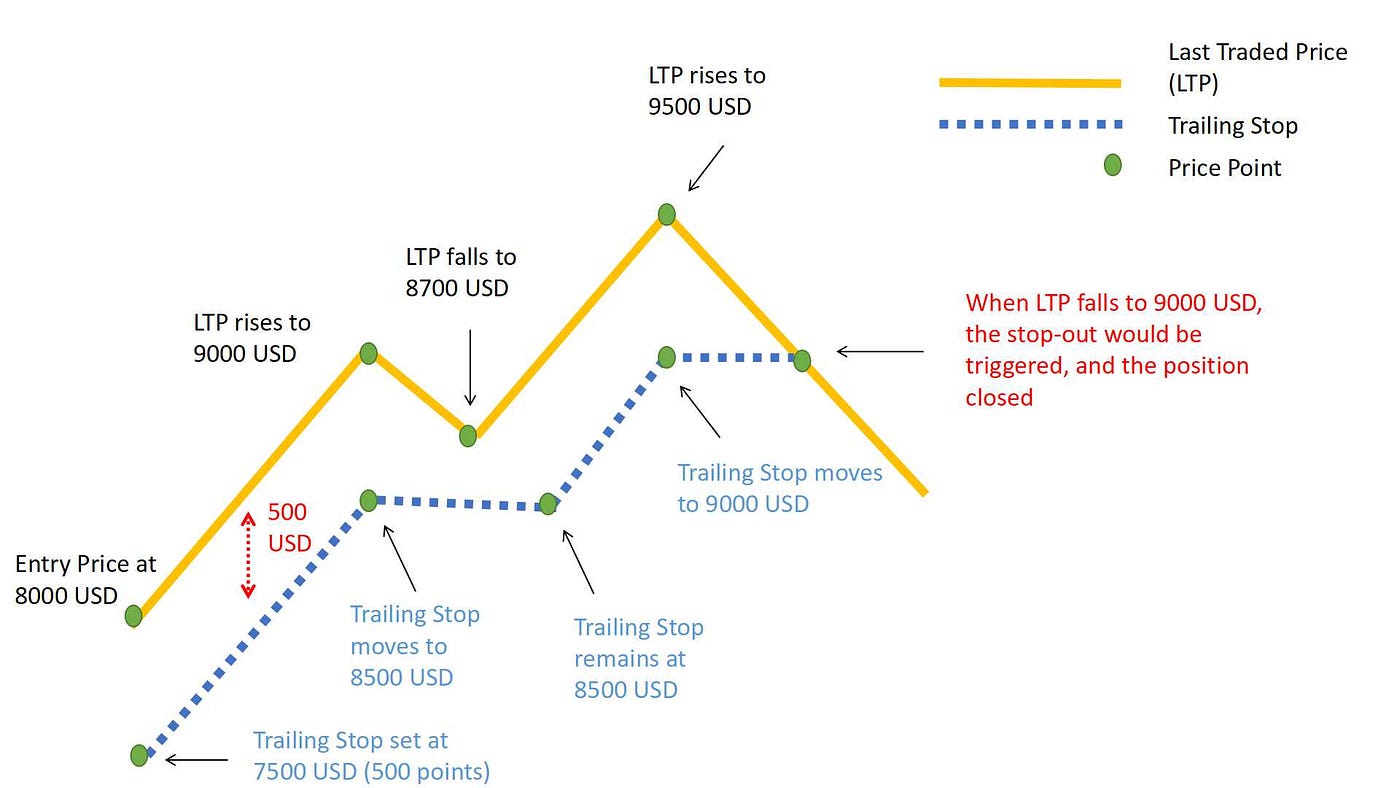

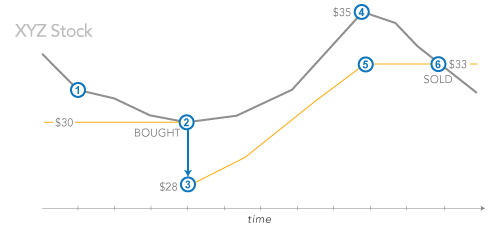

Learn how to use a trailing stop loss order and the effect this strategy may have on your investing or trading strategy. A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock. It enables an investor to have some downside.

Trailing stop orders may have increased risks due to their reliance on trigger pricing. It enables an investor to have some downside. Stop quote vs trailing stop quote.

This strategy may be a little difficult to follow and is used by. Since we entered the trade at 12250 the trailing stop locked in 50 pips of profits if the. Trailing stop limit might often seem an obviously better option due to the greater flexibility it provides.

Think of the stop as a trigger that will initiate the purchasesale and the limit as a condition. Trailing stops can also be used to lock in profits. Stop on quote orders can.

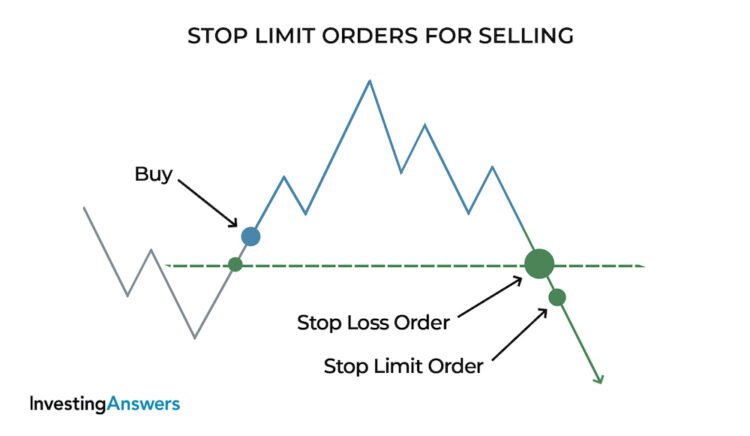

It lets you accomplish this without continuously watching the price of the stock. It is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far. Stop Quote limit order is a combination of both a stop quote and a limit order.

If the price subsequently drops to your stop price you will sell at the stop price or worse even though in the meantime you could have sold at a so much higher price. A trailing stop limit order can set a specify percentage or a dollar amount to exit the trade. For example say you have a stock trading at 10 and you put a stop loss at 9 and a stop limit at 850.

Suppose the price of your security goes way up after you enter the stop order market or limit doesnt matter. The sell trailing stop limit order can be used to build discipline into your trading strategy by providing a way to benefit from potentially higher upside prices while specifying a limit on the potential downside prices of a stock. However stop limit orders carry more risks even though they entitle more direct control over trades.

Other approaches employ security-specific stops such as average true range percentage ATRP stops. If the stock suddenly crashes to 7 making your sell order at 7 the. Even though he had 10000 invested.

A trailing stop limit order allows you to set a specific trigger price this quantifies how much the price should move against the trade before an exit signal. The point of stop-loss orders is to automatically close your position if some conditions is met a long position goes too low or a short. Generally a Stop on Quote is called a stop loss or stop order a stop limit on quote is called a stop limit and a trailing stop is well.

When you pass the trigger price the order goes in as a limit order. Just use stop orders. Another strategy is the support method.

For example some theories employ general stops such as a 6 trailing stop set on all stocks. Our trailing stop would trail the price and move the stop-loss order to 12300 ie. Sell order for stop quote limit order is placed when the price is below the stocks current market price and it will trigger when the price is lower than the decided price.

A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. A trailing stop is a stop order that can be set at a defined percentage away from a securitys current market price.

Stop on Quote vs. A trailing stop limit is an order you place with your broker. When you pass the trigger price order goes in as a standard limit order.

Stop quote orders are the same as stop orders but have been renamed by Merrill Edge in 2013 due to a FINRA rule change. Investing 101 Investing Strategies. A buy trailing stop limit order is the mirror image of a sell order.

100 pips below the current price level. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. So you set.

An investor places a trailing stop for a long position below the. It places a limit on your loss so that you dont sell too low. A buy or sell stop quote on Merrill Edge will be executed once the market price hits the specified stop quote level.

Say you own XYZ right now at 100share but youre afraid itll go down. In this article well go over why Merrill Edge decided to rename their stop order and stop limit order to. Put simply a trailing stop order is a risk management technique where a trader sets their stop loss level to trail the current market price by a specified value or percentage.

Suppose theres a free-fall for one of the securities you are trading.

An Introductory Guide To Trailing Stop Trailing Stop Loss And Trailing Stop Sell Order In Cryptocurrency By Trailingcrypto Medium

Stock Market In Trailing Stop Limit Orders What Does The Limit Offset Mean Economics Stack Exchange

Trading Up Close Stop And Stop Limit Orders Youtube

/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-3e4697527ad041809b1528ed6d5e0fa2.jpg)

Trailing Stop Stop Loss Combo Leads To Winning Trades

Stop Limit Order Examples Meaning Investinganswers

Trailing Stop Loss Vs Trailing Stop Limit Which Should You Use

Trailing Stop Sell Stop Loss Orders Trailingcrypto

Stop Vs Limit Orders What Are The Types Of Orders In Trading

As Part Of Your Trading Strategy You Should Use A Trailing Stop Loss Instead Of A Fixed Profit Target In A Good Tr Trend Trading Trading Quotes Trading Charts

What Is A Trailing Stop Order Novel Investor

Trailing Stop Buy Trailing Buy Order Trailingcrypto

A Brief Guide About Bybit Trailing Stop Different Type Of Perpetual Contacts And Coinswap Part 3 By Ms Bybit Bybit Ambassadors Medium

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

Trailing Stop Loss How Trailing Stop Loss Order Works Trailingcrypto

Trading Faqs Order Types Fidelity

Shorting Cryptohopper Documentation

What S The Most Effective Way To Set A Trailing Stop In Forex Quora